If you’ve been frustrated by the lack of homes for sale over the past few…

How Smart Buyers Are Approaching Rising Mortgage Rates

Last week, the average 30-year fixed mortgage rate from Freddie Mac inched up to 3.1%, and experts project rates will continue rising through 2022:

“The 30-year fixed-rate mortgage was 2.9% in the third quarter of 2021. We forecast mortgage rates to increase slightly through the remainder of the year and reach 3.0%, rising to 3.5% for full year 2022.”

If you’re thinking of buying a home, here are a few things to keep in mind so you can succeed even as mortgage rates rise.

Taking Time Off Can Be Costly

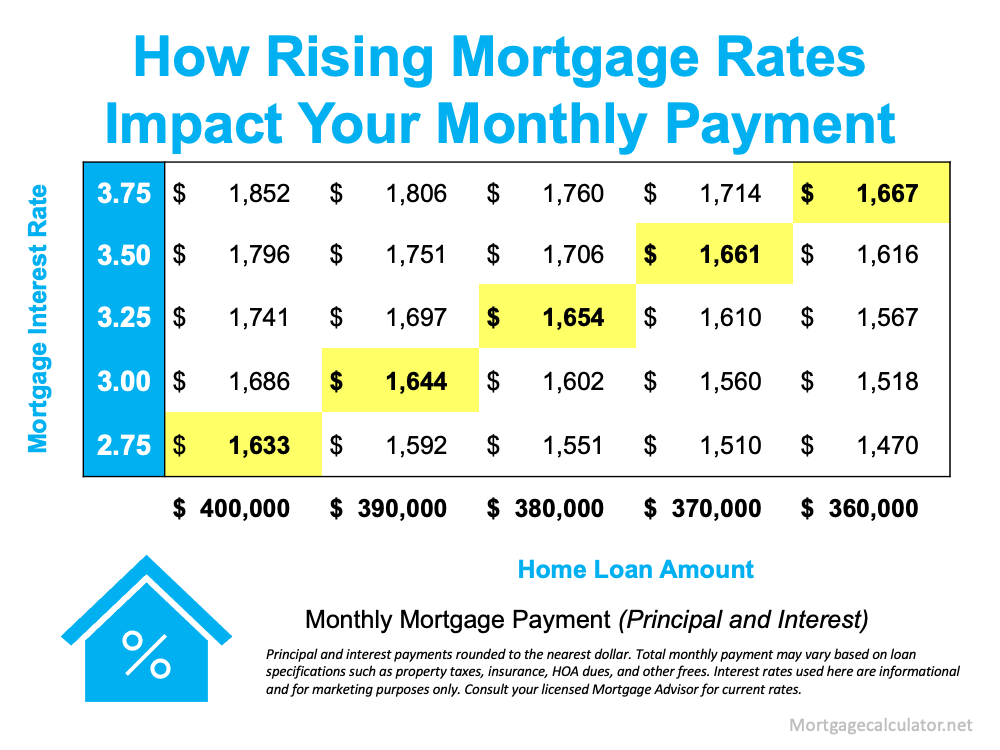

Mortgage rates play a significant role in your home search. As rates go up, your monthly mortgage payment increases if you’re buying a home, directly affecting how much you can afford. And even the smallest increase can have a large impact on your monthly payment (see chart below): With mortgage rates on the rise, you’ve likely seen your purchasing power impacted already. Instead of waiting and hoping rates will fall, today’s rates should motivate you to purchase now before rates increase more.

With mortgage rates on the rise, you’ve likely seen your purchasing power impacted already. Instead of waiting and hoping rates will fall, today’s rates should motivate you to purchase now before rates increase more.

Smart Buyers Can Succeed by Planning Ahead

You can use your newfound motivation to energize your search and plan your next steps accordingly so you’re prepared to act no matter what happens with mortgage rates. One way to do that: take rising rates into consideration as part of your budget.

Danielle Hale, Chief Economist at realtor.com, puts it best, saying:

“Smart buyers should consider calculating a monthly payment not only at today’s rates, but also at rates that are a bit higher so that they won’t be derailed by a sudden upward move. . . .”

You should also be ready to act when you find the home that meets your needs. That means getting pre-approved with a lender so there won’t be any delays when the time arrives.

The best way to prepare is to work with a trusted real estate advisor now. An agent can connect you with a lender, help you adjust your search based on your budget, and be ready to act quickly when it’s time to make an offer.

Bottom Line

Serious buyers should approach rising rates as a motivating factor to buy sooner, not a reason to wait. Waiting will cost you more in the long run. Let’s connect today so you can better understand your budget and be prepared to buy your home even before rates climb higher.

Content previously posted on Keeping Current Matters