Let’s face it – life can throw some curveballs. Whether it’s a job loss, unexpected…

Foreclosure Numbers Are Nothing Like the 2008 Crash

If you’ve been keeping up with the news lately, you’ve probably come across some articles saying the number of foreclosures in today’s housing market is going up. And that may leave you feeling a bit worried about what’s ahead, especially if you owned a home during the housing crash in 2008.

The reality is, while increasing, the data shows a foreclosure crisis is not where the market is headed.

Here’s the latest information stacked against the historical data to put your mind at ease.

The Headlines Make the Increase Sound Dramatic – But It’s Not

The increase the media is calling attention to is a little bit misleading. That’s because it’s comparing the most recent numbers to a time when foreclosures were at historic lows. And that lopsided comparison is making it sound like a much bigger deal than it actually is.

Back in 2020 and 2021, there was a moratorium and forbearance program that helped millions of homeowners avoid foreclosure during challenging times. That’s why numbers for just a few years ago were so low.

Now that the moratorium has come to an end, foreclosures are resuming and that means numbers are rising. But it’s an expected increase, not a surprise, and not a cause for alarm. Just because foreclosure filings are up doesn’t mean the housing market is in trouble.

To prove that to you, let’s expand the comparison out a bit more. Specifically, we’ll go all the way back to the housing crash in 2008 – since that’s what people worry may happen again.

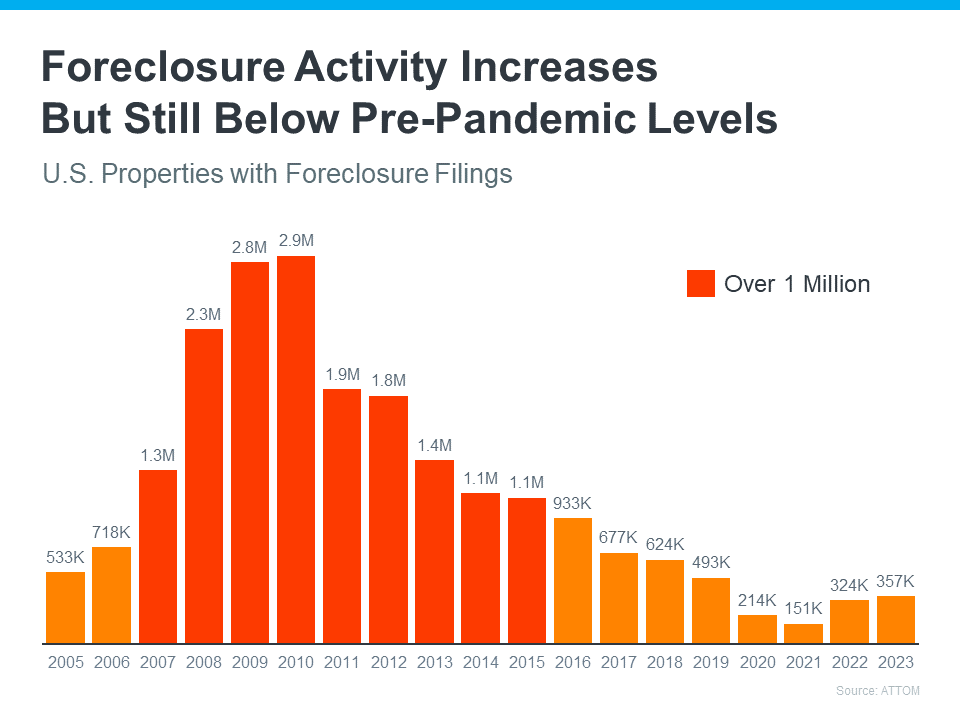

The graph below uses research from ATTOM, a property data provider, to show foreclosure activity has been consistently lower since the crash in 2008:

What the data shows is that things now aren’t anything like they were surrounding the housing crash. The bars in red are when there were over 1 million foreclosure filings a year. In 2023, there were roughly 357,000. That’s a big difference.

A recent article from Bankrate explains one of the reasons things aren’t like they were back then:

“In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That’s not the case now. Most homeowners have a comfortable equity cushion in their homes.”

Basically, foreclosure activity is nothing like it was during the crash. That’s because most homeowners today have enough equity to keep them from going into foreclosure. And that’s a really good thing for homeowners and for the market.

The reality is, the data shows a foreclosure crisis is not where the market is today, or where it’s headed.

Bottom Line

Right now, putting the data into context is more important than ever. While the housing market is experiencing an expected rise in foreclosures, it’s nowhere near the crisis levels seen when the housing bubble burst, and that won’t lead to a crash in home prices.